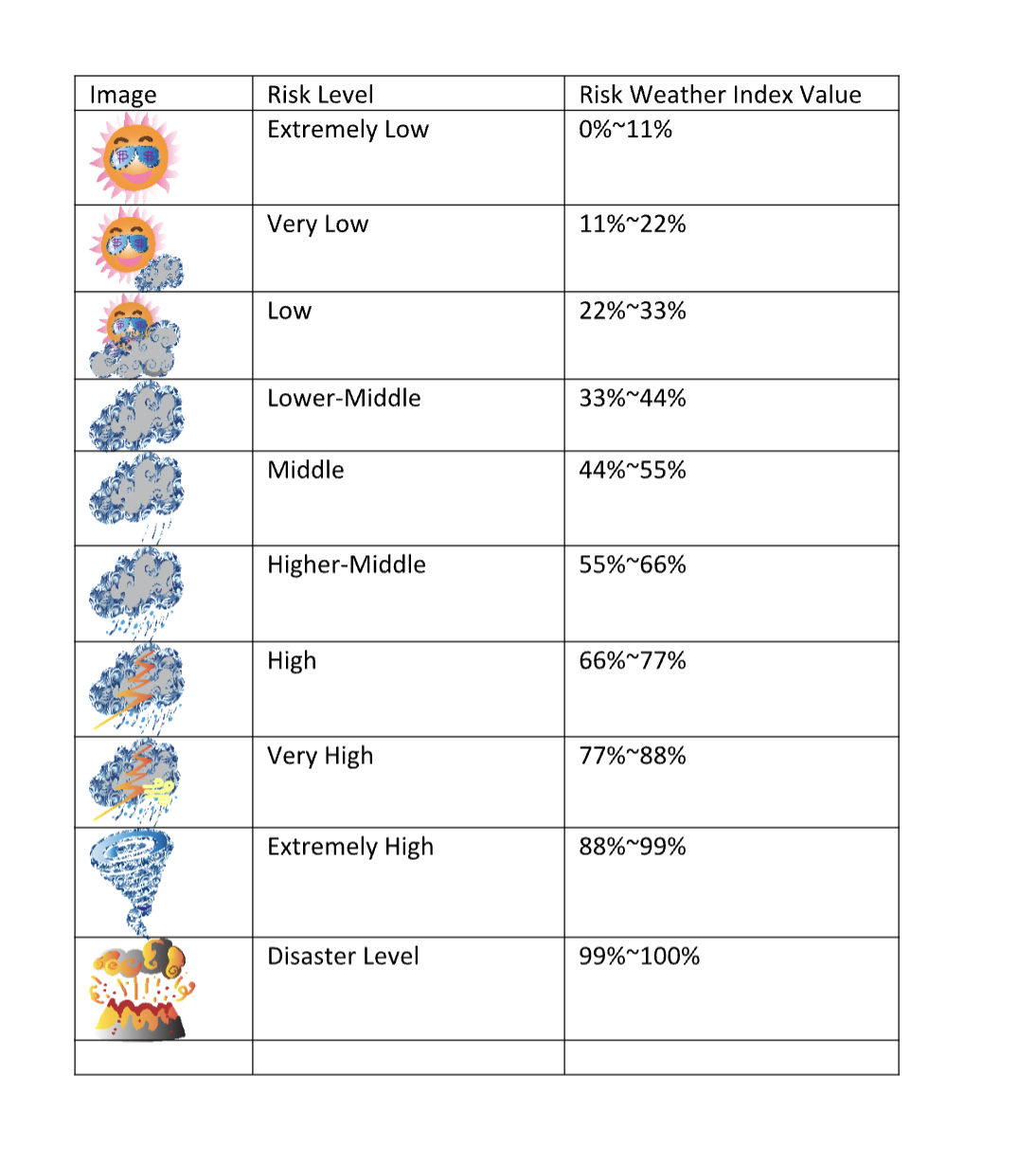

GNE Tech Holdings launches ‘Risk Weather’ serviceGNE Tech Holdings launches ‘Risk Weather’ service: GNE Tech Holdings launches ‘Risk Weather’ service. This service is the first to provide individual investors with the risk measurement model used in the existing financial system. Risk is expressed in terms of weather and grade, and more than 4,000 financial products are compared to provide risk grade and maximum possible loss amount. Risk Weather's features and advantages: Risk Weather provides a portfolio analysis function that allows you to measure and monitor the risks of various types of investment assets. Additionally, the risk situation of each country can be identified through the world risk map, and the risk is defined according to the level of trust using the Risk-Weather Index (RWI). GNE Tech Holdings' vision and plan: GNE Tech Holdings seeks to build a financial system where everyone can invest in any value, starting with Risk Weather. In addition, we plan to grow through the launch of financial data analysis services using AI models and cooperation in the financial engineering field. What is the Risk Weather Program?

No one knows exactly when the stock market will crash, for how long, when it will bounce back and how long it will hold up. For this reason, investment advice from Peter Lynch, a well-known fund manager who has run mutual funds at Fidelity with long-term high returns, makes sense. "If you prepare for or predict a stock market crash, you lose far more money than you lose in the stock market crash itself." This story may be advice that exacerbates the anxiety and fear of investors who are anxious about not being able to predict the future. But in reality, it is also very wise advice. As such, the stock market is subjectively influenced by various circumstances, including economic and political variables, so it is very difficult to predict the stock market, and other experts argue that it is completely unnecessary. However, theoretically, as a method of predicting such an uncertain stock market, it can be summarized in two ways: fundamental analysis method and a technical analysis method. The fundamental analysis method is to look at the past and present situation of a company and analyze the current stock value and future stock price. Technical analysis method refers to a method of predicting the future stock price by looking at the historical stock price and trading volume Among these analysis methods, the risk weather program was created to predict the risk of the stock market based on a mathematical model. From 2007 to 2008, as the financial crisis that started with individual financial institutions spread rapidly throughout the global financial market, and as world famous financial institutions went bankrupt in a chain of bankruptcies, countries around the world were struggling to stabilize their financial systems and manage systemic risks. I realized how important it is. However, although the need to manage these risks is increasing, the people who deal with this data are experts in a very limited field, and there are very few cases in which it is presented visually in an easy-to-understand manner to the general public. Therefore, based on scientific and mathematical theories, the purpose of the Risk Weather program is to visualize and show the level of risk occurring in the stock market so that the general public can easily understand it. The Risk Weather program, developed to allow the public to easily understand and easily view complex and professional stock market crisis data.

0 Comments

Leave a Reply. |

Myungja Anna KohArtist Categories

All

Archives

July 2024

|

Proudly powered by Weebly

RSS Feed

RSS Feed